YOUR SARASOTA BUSINESS AND CORPORATE LAW FIRM

BUSINESS & CORPORATE LEGAL SERVICES

BUSINESS & CORPORATE LEGAL SERVICES

BUSINESS & CORPORATE LEGAL SERVICES

We are able to assist you with all your business and corporate legal matters:

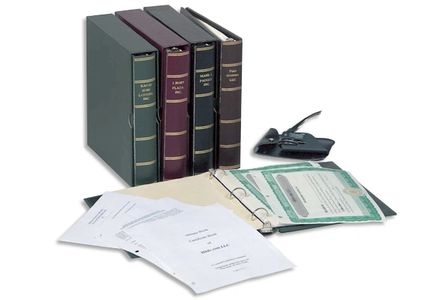

- Selection, incorporation and formation of the proper Florida business entity (Corporation, Limited Liability Co., Partnership, Limited Partnership, Joint Venture, etc...)

- Drafting & negotiation of shareholder, partnership and LLC operating agreements

- Drafting and negotiation of contracts (lease, employment, rental, government, etc.)

- Passing the family business on to the next generation

All of these factors help determine the most appropriate type of corporate legal entity for operation of your new Sarasota or Manatee County Florida business. It can be a: Florida Corporation, Florida Partnership, Florida Limited Liability Company (LLC) or Florida Limited Partnership (FLP). Continue reading to learn more about the advantages of each type of entity.

FLORIDA LIMITED LIABILITY COMPANY

BUSINESS & CORPORATE LEGAL SERVICES

BUSINESS & CORPORATE LEGAL SERVICES

Limited Liability Company ("LLC"): A Florida Limited Liability Company is formed upon the filing of its Articles of Organization with the Florida Division of Corporations. Once established, the Florida LLC operates pursuant to the terms of its Operating Agreement. Basic elements: (i) either Member-managed or Manager-managed; (ii) liability is limited to how much each member puts into the company (personal investment) except any business debt that is personally guaranteed (business loan or line of credit); (iii) management may be exercised by one or more managers (who need not be a member) or by one or more of the members; and (iv) the types and number of members is unrestricted. Most importantly, a creditor of a member of a multi-member LLC is limited to a charging lien against the members interest.

FLORIDA CORPORATION

FLORIDA BUSINESS TRANSACTIONS

FLORIDA BUSINESS TRANSACTIONS

C - Corporation: A Florida business entity. Basic elements: Subject to tax as a separate legal entity (double taxation); Dividends (distributions out of earnings and profits) are subject to tax at the shareholder level; Shareholders are not personally liable (unless they issue a guarantee) for corporate obligations; and Entity is managed and controlled by its officers and directors.

S – Corporation: A Florida pass-through legal entity with no corporate level tax. Basic elements: Shareholders report and pay tax on their pro rata share of income, losses, deductions, etc.; Stock owners reduce their federal income tax bill by paying themselves a reasonable salary (subject to payroll taxes) and a dividend (distributed free of employment tax); May only have one class of stock; and less than 100 shareholders.

FLORIDA BUSINESS TRANSACTIONS

FLORIDA BUSINESS TRANSACTIONS

FLORIDA BUSINESS TRANSACTIONS

We have over thirty (30) years experience assisting business clients with:

- Drafting & negotiation of Shareholder, Partnership and LLC Operating Agreements

- Drafting and negotiation of contracts (lease, employment, rental, government, etc.)

- Purchase and sale of business assets (real estate, patents, etc.) & corporate entities